Which?’s Annual Sustainability Report Series 2024: Home insulation and Heating

Executive Summary

The UK government needs to make rapid progress in reducing carbon emissions from home heating if it is to meet its legally binding net zero commitments. Over recent years the UK has made good progress in reducing emissions from energy generation, and decarbonising the electricity grid is a major focus for the new government. However, as targets for the decarbonisation of energy generation are reached, the government will increasingly have to address areas that have a more direct impact on consumers, such as home heating which accounts for more than 18% of UK emissions.

Our research has found that many consumers feel a sense of personal responsibility for reducing their environmental impact and this has increased over the last four years. Consumers are also clearly concerned about high energy prices and the cost of keeping their homes warm in winter. However, to date, this responsibility and these concerns has not resulted in enough action to make the changes necessary for more sustainable home heating.

At the heart of the changes required to make home heating less damaging to the environment will be a switch from using fossil fuels such as oil and gas to heat our homes, to electrified heating such as heat pumps. Alongside these changes many households will also need to make improvements to the insulation of their homes to improve the efficiency of their heating, and some will also consider adding solar panels to generate their own electricity. Making these changes will not only reduce household emissions but will also help to tackle high and volatile energy bills.

A worrying lack of awareness about heat pumps

In order to understand the prospects for increasing heat pump adoption, our research focused on homeowners. Homeowners account for the largest proportion of households in the UK and are in a position to make decisions themselves about how to heat their homes. However, for many homeowners, we found that heat pumps remain an unknown quantity, with 43% saying they don’t know enough about them. This figure is very similar to last year (44%).

This lack of knowledge about heat pumps is reflected in the lack of awareness about their importance in reducing carbon emissions. When asked to rank nine behaviours that result in the largest reduction in carbon emissions, consumers placed getting a heat pump second last. In fact, for most homeowners switching to electrified heating would be either the most, or the second most, impactful change they could make. This lack of awareness about the importance of heat pumps in reducing carbon emissions is a critical barrier to overcome in encouraging homeowners to switch.

However even when homeowners are aware of what heat pumps are, many are not yet ready to consider purchasing one, with high upfront costs being the greatest concern (71%). There are some important differences according to age, with younger homeowners more likely to own a heat pump and more likely to consider purchasing one. But overall, only 46% of homeowners that are aware of heat pumps say they would, or might, consider getting a heat pump if their heating system needed replacing in the next 12 months - a decrease of 3% compared to last year. This is clearly a move in the wrong direction at a time when the country needs to be accelerating adoption if it is to meet its net zero targets.

Cost is a major barrier across all measures

As with heat pumps, the cost of improving insulation or installing solar panels is the most important barrier for homeowners, however concerns about payback periods and disruption are also significant. Improving information and advice could improve adoption, with some quick wins possible with low cost insulation measures.

There are considerable differences in consumers' adoption of different insulation measures. Double or triple glazed windows are the most popular form of insulation, possibly due to the aesthetic value and their ability to stop draughts that can have a significant impact on the comfort of a home. More effective, but more costly, disruptive, and less well known measures, such as solid wall insulation and floor insulation, are the least popular measures. It is noteworthy that there are still many households, especially those owned by younger homeowners, that could reduce their emissions and energy bills by installing some of the lower cost insulation measures that have faster payback periods, such as draught proofing, loft insulation and insulating hot water cylinders and pipes.

Solar panels are a relatively popular technology and help to reduce energy bills by enabling households to generate their own electricity. Falling prices, their visibility on rooftops and the relative lack of disruption when installing solar panels may account for their popularity. However only a small proportion of lower income households (14%) said they would consider installing them, showing it is currently an unaffordable option for many.

The Warm Homes Plan - an opportunity for change

The projections needed for the UK to achieve its net zero targets show that progress needs to be significantly faster than at present. It is positive that the number of heat pump installations has started to increase and our research shows there are households that are willing to consider making changes to their heating system in the next year, but more is needed.

In order for more households to see these changes as a positive option, the government will need to address the significant barriers that our research has identified. These include limited awareness, concerns about the cost of the changes, a lack of information and advice, and the ability to find qualified and reliable installers.

The government has an opportunity to address these issues in their Warm Homes Plan that is expected to encompass their approach to home heating. To be successful the plan must set out how these barriers will be addressed in a coordinated way so that consumers are aware of the need for change; they have access to good quality independent information and advice; new financial products and running costs make the change more affordable; and they have assurance that installers are qualified and reliable.

pdf (1.71 MB)

There is a file available for download. (pdf — 1.71 MB). This file is available for download at .

Introduction

The UK government has set a legally binding target for the UK to meet net zero by 2050. The UK has made good progress in reducing its carbon emissions by making changes to the way energy is produced and reducing carbon emissions from supply chains. However the next phase of reductions will have a more direct impact on consumers as they are asked to make changes to purchasing decisions and behaviours that have a significant impact on the environment. These changes will include switching from petrol and diesel cars to electric cars and switching from gas and oil heating to electrified heating. Consumers therefore have a pivotal role to play in the UK’s transition towards achieving net zero emissions. For many consumers these changes are both costly and complex decisions. In its first 100 days the new UK government has focused on its ambition to decarbonise the electricity grid, but manifesto pledges to deliver a new Warm Homes Plan and support the roll out of EV charging infrastructure demonstrate awareness of the consumer challenges ahead.

As the UK’s consumer champion, Which? is committed to supporting consumers in this transition to net zero. Our aim is to make it as simple, fair and safe as possible. We therefore work with government and businesses to ensure the consumer voice is heard in the development of policies that have an impact on the environment, with the aim of minimising consumer harm in the transition and making it easier for consumers to make the changes that are required to meet sustainability targets. This advocacy work has a particular focus on sustainable home heating and electric vehicles, whilst also supporting wider developments to reduce emissions in the energy sector and action to tackle green claims that mislead consumers.

Which? also provides consumers with information and advice, covering topics from home heating to the durability of products. All of this content is brought together in our sustainability hub, giving consumers free advice on how to buy and use products more sustainably.

The tracker survey

For the last three years, Which? has been tracking consumers’ attitudes towards sustainability, behaviours and barriers to change through an annual tracker survey. The survey covers some of the most significant consumption behaviours in relation to carbon emissions, including how we heat our homes, the transport methods we use and what we eat (Table 1). These are important consumer behavioural changes that the Climate Change Committee’s Sixth Carbon Budget: The UK’s path to Net Zero report points towards as being crucial in meeting the UK’s net zero targets. These behaviours are a mix of lifestyle choices and the purchase of technology to reduce carbon emissions.

Table 1: This sustainability tracker focuses on nine desirable consumer behaviours to reduce carbon emissions

| Sector | Behaviour change | Type of behaviour |

Transport | Reduce car use in favour of alternative transport | Lifestyle choice |

| Switch to an electric vehicle | Purchase decision | |

| Reduce holiday travel emissions | Lifestyle choice | |

Energy / home heating | Reduce home energy use | Lifestyle choice |

| Receive electricity supply from greener sources | Purchase decision | |

| Improve home insulation | Purchase decision | |

| Install a heat pump | Purchase decision | |

Food | Reduce and recycle food waste | Lifestyle choice |

| Consume less red meat and dairy | Lifestyle choice |

This report primarily focuses on the findings of the June 2024 sustainability tracker, a survey of 2,108 UK adults conducted by Yonder on behalf of Which?. It also incorporates insights from earlier Which? sustainability surveys, allowing us to understand how consumer attitudes and behaviours have evolved over time. [1] The data has been weighted to be nationally representative of UK adults.

Outline of report

Chapter 1 of this report provides insight into consumer attitudes towards climate change, as well as an overview into how many consumers are adopting these nine desirable behaviours and their attitudes towards future adoption.

Chapters 2 to 4 focus on the home heating behavioural changes, specifically improving home insulation, installing a heat pump and solar panels [2].

- Chapter 2 provides an overview of this sector, progress to date and an overview of current government policy.

- Chapter 3 presents our research findings, outlining consumers’ current attitudes to these behavioural changes, the barriers they face in doing them, and the support that will be needed to assist consumers in these transitions.

- We finish with our policy recommendations in Chapter 4.

Chapter 1: An overview of consumer behaviours and attitudes

Summary of chapter

- A high proportion of consumers remain concerned about climate change (76%) and feel responsible for reducing their impact on the environment (81%).

- While consumers are making some lifestyle changes, such as cutting down on food waste by composting or recycling (52%), certain sustainable behaviours have much lower uptake, especially major purchase decisions like buying an electric vehicle or changing to electrified heating.

- Concerningly, a high proportion of consumers remain worried about making these choices in the future. For example, only one in 10 homeowners said they would consider installing a heat pump if their heating system needed replacing in the next 12 months (9%).

- Across nine sustainable behaviours, there was no significant change in consumer behaviours or attitudes. 18% of UK adults were classed as Low Emitters, 52% Small Adjusters and 30% as High Emitters. This is very similar to last year.

Consumers are concerned about climate change and feel responsible for reducing their impact on the environment

Our sustainability tracker survey in June 2024 found that more than 3 in 4 (76%) UK adults are concerned about climate change (36% very concerned and 40% somewhat concerned). This worry is fairly similar to previous years, albeit with a small upward trend in those very concerned (33% in June 2022). Concern is widespread across various age groups, with the highest level observed among younger adults aged 18 to 34 years old (81%), compared to 35 to 54 year olds who are the least concerned (72%). Older individuals aged 55 and above also show considerable concern, with three quarters (75%) sharing these concerns.

Despite this nuance across age groups, over four in five UK adults feel responsible for lessening their environmental footprint (81%). This feeling of personal responsibility is at similar levels to last year (82%), but higher than June 2021 (77%) and June 2022 (78%).

Figure 1: Proportion of UK adults feeling a responsibility to cut their environmental footprint

Source: Which? Sustainability Tracker surveys, Online Poll weighted to be nationally representative, approx 2,000 respondents per wave. Respondents were asked: How responsible, if at all, do you feel to reduce your own impact on the environment, i.e. to reduce your carbon footprint?

Current consumer behaviours

All UK adults (100%) report at least one type of behaviour that lowers their impact on the environment. The most common behaviours consumers reported are reducing home energy use (eg having the heating on less often or switching off appliances at the mains), having double or triple glazing in their homes, or reducing and recycling food waste.

Table 2: Current uptake of sustainable behaviours

| Sector | Behavioural change | Uptake |

Transport | Reduce car use in favour of alternative transport | 27% of UK adults do not drive and 23% of drivers often use alternative travel |

| Switch to an electric vehicle | 4% of drivers have an electric vehicle and 6% either a full or plug-in hybrid | |

| Reduce holiday travel emissions | 20% of holidaymakers say they always or often choose alternative travel options to avoid flying | |

Energy / home heating | Reduce home energy use | Almost all (96%) UK adults report at least one energy saving habit, eg switching lights off when not needed |

| Receive electricity supply from greener sources | A quarter (26%) of UK adults have their electricity supply with a ‘green electricity provider’ and 15% are on a ‘green or renewable tariff’ | |

| Improve home insulation | Nine in 10 homeowners say their home has double or triple glazing (91%), 56% have either cavity or solid wall insulation and half have draught-proofing (48%) | |

| Install a heat pump | 2% of homeowners have a heat pump | |

Food | Reduce and recycle food waste | Three in four UK adults cut down on food waste by planning what they buy (73%) and half cut down by composting or recycling (52%) (always or often) |

| Consume less red meat and dairy | A quarter of UK adults always or often cut down on or avoid eating meat and dairy (25%) |

As shown in Table 2, most consumers are making some lifestyle changes to their everyday behaviours. Whether they are doing these for sustainable reasons or have other motivations, like reducing their energy bills, they will have some impact in lowering their carbon footprint.

Changes that involve a large purchase lag behind, both with lower uptake and greater reluctance amongst consumers to try them in the future. For example, only one in 50 homeowners have a heat pump (2%). Of those who do know what heat pumps are, only one in six say they would definitely consider installing one if needed in the next 12 months (16%). Similarly, only one in 25 drivers have a fully electric vehicle (4%) and only 6% of current non-EV drivers intend to buy an EV as their next vehicle, whilst four in 10 say they would not consider buying one (39%).

Taking both current behaviours and consumer attitudes together, we classify consumers into three groups. More detail regarding this classification can be found in the annex of this report. The groups were;

- Low Emitters who are already doing many of these desired behaviours or intend to in the near future,

- Small Adjusters who are on the journey to integrating these sustainable behaviours into their lives and open to more in the future, and;

- High Emitters who have yet to make many significant changes to their behaviours and do not intend to in the future.

One in five adults are Low Emitters (18%), taking significant steps to reduce their environmental impact, and more than half the population (52%) are Small Adjusters, taking smaller steps in this direction, and are open to further changes in the future. However three in ten (30%) are High Emitters who haven't yet taken any significant steps to curb their environmental impact, and do not intend to do so in the future. As shown in Figure 2, this is very similar to last year, demonstrating that consumer behaviours and attitudes have not changed significantly.

Figure 2: Classification of consumers by their sustainable behaviours and attitudes

Source: Which? Sustainability Tracker surveys, Online Poll weighted to be nationally representative. Base sizes: June 2023 (2,067), June 2024 (2,108).

This lack of movement in relation to environmentally damaging behaviours contrasts with the progress that is needed if the government is to meet its commitment to reach net zero by 2050. The most recent progress report from the Climate Change Committee noted that the government is off track to meet its international commitments for carbon reduction. In the past, significant progress has been made in cutting carbon emissions from energy production, however the focus is now switching to changes that will have a greater impact on consumer choices. The Climate Change Committee’s report identifies the slow uptake of heat pumps and electric vehicles as two areas of particular concern.

Consumers face many challenges adopting these behaviours

Consumers’ behaviours and attitudes in these areas reflect the significant barriers they face when considering more sustainable options. While these barriers vary depending on the type of sustainable behavioural change, there are common themes that cut across them.

Figure 3: Barriers consumers experience preventing them from adopting transport, home energy and food sustainable behaviours

Source: Which? Sustainability Tracker Survey 2024.

As shown in Figure 3, while cost is often a major barrier to consumers making these sustainable lifestyle changes or large purchases, consumers can also be limited by a lack of choice, a lack of information or face practical constraints. In addition, concerns about the capability of current technology may stop them making changes to the behaviours or simply personal preferences.

Consumer understanding of behaviour changes

In addition to asking consumers' about the barriers that stop them making these sustainable choices, we also asked them which behaviours they thought would lead to the greatest reduction in carbon emissions (regardless of whether they do the activity or not).

Interestingly, the behavioural changes consumers ranked the highest (having the greatest reduction in emissions) tended to be behaviours they are already doing and are behaviours that will actually have a lower impact on carbon emissions compared to others (Table 3). For example, installing a heat pump came eighth in consumers’ ranking, despite this behaviour change contributing to one of the biggest reductions in carbon emissions.

Table 3: Consumers’ ranking of behaviours in terms of the greatest reduction in carbon emissions

| Ranking | Behavioural change | Type of behaviour |

| 1st (Greatest reduction) | Reduce home energy use | Lifestyle choice |

| 2nd | Receive electricity supply from greener sources | Purchase decision |

| 3rd | Reduce holiday travel emissions | Lifestyle choice |

| 4th | Reduce car use in favour of alternative transport | Lifestyle choice |

| 5th | Improve home insulation | Purchase decision |

| 6th | Switch to an electric vehicle | Purchase decision |

| 7th | Reduce and recycle food waste | Lifestyle choice |

| 8th | Install a heat pump | Purchase decision |

| 9th (Smallest reduction) | Consume less red meat and dairy | Lifestyle choice |

*Green = Energy / home heating, Blue = Transport, Yellow = Food

The three behavioural changes that are major purchase decisions - improving home insulation, switching to an electric vehicle and installing a heat pump - all come low down in the ranking meaning that consumers believe they will result in smaller reductions in emissions. These are also behaviours with some of the lowest uptake to date and can cost consumers thousands of pounds. However, they would be expected to have the greatest impact in terms of reducing the average consumers’ emissions. This mistaken consumer understanding demonstrates the need to support consumers making sustainable choices, both through improving their understanding of these products and tackling the barriers they currently face in purchasing them.

The remainder of this report will explore the purchase decisions of installing a heat pump, improving home insulation, and installing solar panels in more detail. More detailed analysis of switching to an electric vehicle can be found in our other report.

Chapter 2: The home heating challenge

The following chapters look specifically at home heating which accounts for 18% of UK emissions. It is one of the most challenging areas in the transition to net zero as it will involve more than 90% of UK households that currently rely on gas or oil heating making the change to low carbon heating. Homeowners also lack awareness of the impact home heating has on the climate, are often unaware of alternative heating systems such as heat pumps, and have significant concerns about their cost and effectiveness.

Home heating is also an important issue for UK consumers due to the energy price rises that have put enormous pressure on household finances since 2021. It is estimated that 13% (3.17m) of households in England are in fuel poverty and energy debt stands at £3.1 billion. Many other households that are not in fuel poverty or energy debt will still be feeling the additional strain caused by historically high energy prices. Fortunately the transition away from gas and oil heating will not only reduce the UK’s impact on the climate, but also deliver lower and more stable prices.

Heating systems, insulation and microgeneration

For most households, the transition to low carbon heating will mean installing a heat pump, though other heating systems are available for properties where a heat pump is not suitable. The typical cost for installing a heat pump is currently approximately £13,000, however most households in the UK are eligible for a grant of £7,500 towards this cost.

Households should also consider whether their home is sufficiently insulated. Improving insulation reduces heat loss and makes the heating system work more efficiently. In particular fuel poor households often live in poorly insulated homes and grants to support improved insulation can help to reduce bills for these households. Self-funding households will want to weigh up the cost of installing insulation and the savings that can be made, but improving insulation does help to reduce bills as well as improving the comfort of a home.

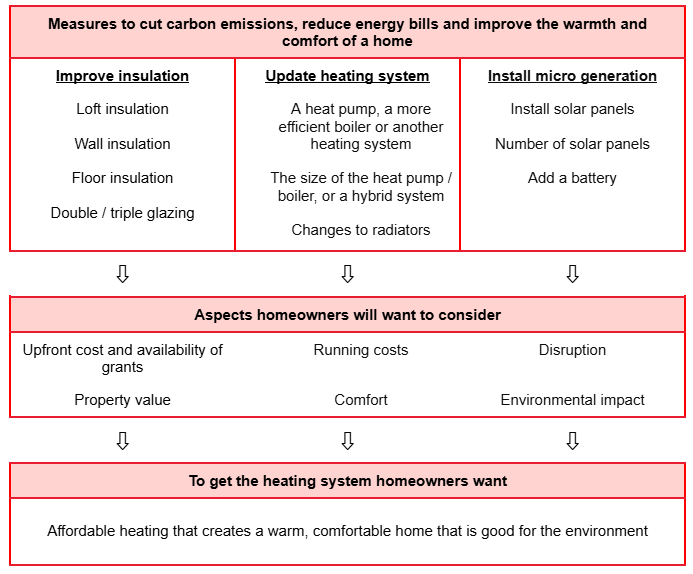

As shown in Figure 4, the complexity of these choices, as well as the cost and unfamiliarity of the equipment, make this a particularly challenging transition for consumers.

Figure 4: Options for homeowners when updating home heating

Households' choice of heating system and insulation will differ according to their property. Households may consider improvements to insulation at the same time as they change their heating system or make incremental improvements before installing a new system. When considering how much insulation to install there may also be a trade off between getting a larger heating system or more insulation.

In addition consumers may also consider installing solar panels in order to generate their own electricity. Depending on their property this can make a substantial impact on the cost of heating their home, as well as running their appliances and charging an electric vehicle if they have one. The benefits can be further increased if the panels are combined with a battery.

Progress to date

The last UK government set a target for 600,000 heat pumps to be installed every year by 2030. From January to July 2024, more than 30,000 heat pumps were installed in homes and small businesses across the UK, which is a 45% increase compared to the same period in 2023 but is still considerably lower than is required to meet the target.

There are also a number of targets for improving the energy efficiency of homes, although none of these are currently legal requirements except for the requirement that privately rented properties should be EPC E or above. The government has said they will introduce a new requirement for these properties to be EPC C by 2035.

There has been rapid growth in the number of small scale solar installations with the number of installations in 2022 being double the previous year. This was driven by rising energy prices but the popularity of solar panels can also be explained by its relative visibility, and the relative lack of disruption incurred when panels are installed.

Government policy

The UK and Scottish governments have a number of grant schemes available to support the transition to low carbon heating and improve the insulation of homes. Funding from the UK government and the Energy Company Obligation (ECO) scheme for home insulation and heating upgrades is predominantly targeted at low income households and social housing, whereas Scottish government funding in the form of grants and low interest loans is available to more households. Currently neither government has any targets or programmes specifically to support the installation of solar panels.

The UK, Scottish and Welsh governments also undertake awareness campaigns and provide information and advice to consumers. The reach of these campaigns and the level of service differs between the nations. Governments are also working to support the growth of the supply chain through grants for training and apprenticeships. In order to promote the quality of installations the UK government requires that any work undertaken using a government grant is completed by an installer that is certified by TrustMark or MCS. The government also signposts consumers towards these schemes on their website, but there is no requirement for installers to be certified if the consumer is paying for the work themselves.

Since winning the election the UK government has focused on their ambitious commitment to decarbonise the electricity grid by 2030. This will mean that imported fossil fuels such as gas will no longer be used to generate the UK’s electricity, and instead renewable sources such as wind and solar, as well as nuclear, will be used.

However, in order to make a difference to consumers' bills it will be necessary for households to switch to electrified systems such as heat pumps, to heat their homes and provide hot water. Without this change households will continue to rely on gas and oil and won’t realise the stability and lower bills promised by the new government.

In their election manifesto, the Labour Party committed to a Warm Homes plan that would address the demand side of the energy equation. The Warm Homes Plan includes a commitment to increase funding for energy efficient households by an extra £6.6 billion over the next parliament and offer grants and low interest loans to support investment in insulation and other improvements such as solar panels, batteries and low carbon heating to cut bills. The government has also said it will work with the private sector, including banks and building societies, to provide further private finance to accelerate home upgrades and low carbon heating.

The next section shows insights from our sustainability tracker surveys, covering current consumer behaviours, attitudes and barriers towards installing a heat pump, improving their home insulation and installing solar panels.

Chapter 3: Research findings

Heat pumps

Ownership and consideration remains unchanged

Heat pump ownership levels amongst homeowners have remained low at 2% in 2023 and 2024.

Whilst knowledge of heat pumps amongst homeowners without them has increased a little over the past year (54% to 56%), this has coincided with a slight increase amongst those who know what they are saying they wouldn’t consider installing one (51% to 54%).

Combined together, this results in no change in those considering installing a heat pump in the future. In other words, the slight increase in awareness isn’t translating into higher adoption or consideration. As shown in Figure 5, only one in 10 current homeowners (9%) said they would definitely consider installing a heat pump if they needed to replace their current heating system in the next 12 months (also 9% in 2023).

Figure 5: Heat pump ownership, awareness, knowledge and consideration amongst homeowners

Source: Which? Sustainability Tracker 2024. Respondents were asked: (1) Which of the following do you currently use as the main source to heat your home?, (2) Before taking this survey, had you heard of heat pumps as a home heating system?, and (3) Would you consider installing a heat pump in your home?. Base: Homeowners (1,416). Percentages are rounded to 0 decimal places.

These figures are concerning at a time when the market should be growing rapidly in order to meet the installation rates that are needed to support the transition to net zero. It also indicates that simply increasing general awareness of heat pumps is not sufficient to increase adoption. The UK and devolved governments as well as businesses will need to understand and address the concerns of those who are aware, but who are still opposed to installing a heat pump.

However, there are some positive points, particularly when looking at differences in awareness and consideration across age groups. Younger homeowners are much more open to heat pumps, but many lack knowledge of them

Younger homeowners are both more likely to have heat pumps and more likely to say they would consider installing one.

One in 20 homeowners aged 18 to 34 have a heat pump (5%), compared to just 1% of over 55 year olds. Amongst those who don’t have one installed, 18 to 34 year old homeowners are three times more likely to definitely consider installing one (15% compared to 5% of over 55 year olds) (Figure 6).

Despite this, many young homeowners have never heard of heat pumps. Over a quarter of 18 to 34 year old homeowners without a heat pump have never heard of heat pumps (28%), compared to just one in twenty aged over 55 (5%). In addition, 30% of young homeowners have heard of heat pumps but don’t know what they are.

Figure 6: Homeowners’ knowledge and consideration of heat pumps by age

Source: Which? Sustainability Tracker 2024. Respondents were asked: Before taking this survey, had you heard of heat pumps as a home heating system? and Would you consider installing a heat pump in your home?. Bases: 18 to 34 year old homeowners without a heat pump (247), 35 to 54 year old homeowners without a heat pump (495), 55+ year old homeowners without a heat pump (650).

This shows that while a majority of young homeowners have either not heard of heat pumps or don’t know what they are (58%), those who are knowledgeable are much more open to considering installing one. Despite there being less young homeowners than older homeowners, increasing awareness in this age group could therefore result in many more homeowners being open to installing one in the future.

Those who do other sustainable behaviours are also more open to heat pumps

Homeowners who already live more sustainably than others (in the top tertile for sustainable behaviours done) are also more open to heat pumps. Over a third of this group said they either will or might consider a heat pump (36%), compared to just 17% of those who do the least behaviours currently (in the bottom tertile for sustainable behaviours done). However, a substantial proportion - 30% - of this group are not aware of what heat pumps are. This suggests that there is still some scope to increase installation rates by raising awareness amongst those who are already engaged in other sustainable behaviours.

A range of benefits could encourage homeowners to install a heat pump

Amongst all homeowners without a heat pump, the motivating factor that would most likely encourage them to install a heat pump is saving money on their energy bills (34%), followed by them being more environmentally friendly (21%). Heat pumps being a way for homeowners to future proof their home (12%), having a long lifespan, or needing little maintenance (7%) came in much lower. A quarter of respondents (26%) said none of these factors would motivate them (Figure 7).

Figure 7: Best motivating factor for heat pumps

Source: Which? Sustainability Tracker 2024. Respondents were asked Which ONE of the following benefits about heat pumps is most likely to encourage you to install a heat pump in your home in the future? Base: Homeowners without a heat pump (1,360).

Interestingly, these figures differ significantly when we look at different groups of homeowners. For those who said they would consider installing a heat pump, the environmental benefits are the biggest motivating factor (42%), followed by lowering energy bills (27%). Interestingly, a fifth of these homeowners (20%) were most motivated by the statement “It will be one of the main ways in which people heat their homes in the future and I want to future proof my home”. The environmental and future-proofing motivating factors are also much more common amongst homeowners that already do several other behaviours that are more sustainable.

Conversely, for those who have heard of heat pumps but don’t know what they are, a larger proportion said saving on energy bills would encourage them the most (44%), followed by the environmental benefit (17%).

These figures show that currently environmental factors have an important role in driving heat pump uptake. Consumers that are engaged in other sustainable behaviours are most open to considering a heat pump, and environmental benefits are the key motivating factor for homeowners willing to consider installing a heat pump. There is still scope to raise awareness amongst this group, but if heat pumps are to become more mainstream, it will be important for governments and businesses to consider the factors that motivate homeowners who are less concerned about environmental issues. As our figures show, just raising awareness amongst these homeowners will not necessarily translate into more heat pumps being installed.

The main barrier to consumers’ installing a heat pump is the cost

Along with awareness being a key issue covered above, there are other barriers holding back the wider adoption of heat pumps. Amongst homeowners that know what heat pumps are, the main barrier to installing one is the cost, with seven in 10 homeowners saying this would prevent them installing one (71%) (Figure 8). In addition, just over a third (37%) of homeowners stated that they were not convinced by the technology. Other barriers included it not being appropriate for their property (27%), homeowners being worried they would end up paying more on their energy bills (26%) and it being too much hassle (21%). These barriers have not shifted significantly over the last few years.

Figure 8: Top barriers to homeowners installing a heat pump

Source: Which? Sustainability Tracker 2024. Respondents were asked Which, if any, of the following do you think would prevent you from installing a heat pump in your home? Base: Homeowners without a heat pump who know what they are (789).

Older homeowners are more concerned about the technology

The older the homeowner, the more likely they are to be unconvinced by heat pump technology (Figure 9). Only one in six (17%) of those aged 18 to 34 cited this as a barrier for them. In contrast, 37% of homeowners aged 55 to 64 and nearly half (49%) of those over 65 cited this as a barrier. This shows that while cost is by far the biggest barrier, governments and businesses most also address concerns about the technology.

Figure 9: Homeowners that stated that they weren’t convinced by heat pumps’ technology by age

Source: Which? Sustainability Tracker 2024. Respondents were asked Which, if any, of the following do you think would prevent you from installing a heat pump in your home? Base: Homeowners without a heat pump who know what they are, 18 to 34 year olds (104), 35 to 54 year olds (269), 55 to 64 year olds (139), 65+ year olds (277).

While barriers are similar depending on the type of property homeowners have, it is worth noting that a high proportion of those living in a flat, maisonette or apartment said it wouldn’t be appropriate for their property (59%). Those living in a fully detached house are more likely to not be convinced by the technology (49%) than those living in semi-detached (32%) or terraced (34%) houses - this difference is likely due to older people being more likely to own detached houses.

Summary

Ownership of heat pumps in the UK is still very low and nearly half of homeowners are not aware of them. Worryingly, at present, greater awareness does not necessarily translate into a willingness to consider installing a heat pump in the future. However there are significant differences between groups of homeowners. Younger homeowners and those making other sustainable choices are more willing to consider installing a heat pump.

Main barriers to heat pump adoption

Home Insulation

Most owner-occupied properties have double / triple glazing and loft insulation improvements

The most common type of insulation improvement that homeowners report having is double or triple glazing (91%). Roof / loft insulation is also very common with over eight in 10 homeowners reporting having it (82%).

In contrast, fewer than one in five homeowners (17%) said they have floor insulation, making it the least common form of insulation (Figure 10).

Figure 10: Levels of insulation homeowners reported in their homes

Source: Which? Sustainability Tracker 2024. Respondents were asked Does your home have any of the following insulation improvements?. ✓ = yes, X = No and ? = Don’t know. Base: Homeowners (1,416).

Over half of homeowners (56%) reported having at least one type of wall insulation. A significant proportion of homeowners don’t know what wall insulation they have in their home - 25% of homeowners said they didn’t know if they have solid wall insulation and 16% cavity wall insulation. This demonstrates the importance of good quality information and advice in supporting homeowners that are looking to improve the insulation of their homes. In some cases this advice will need to be tailored to the consumer's home to help consumers understand their options.

Older homeowners tend to report having more types of insulation than younger homeowners

Older homeowners are more likely to live in homes with several different types of insulation and in relation to specific measures there can be marked differences between younger and older homeowners (Figure 11). For example, two thirds of 18 to 34 year old homeowners reported having roof/loft insulation, compared to 92% of over 65 year olds.

Interestingly, the insulation types that differ most by age are improvements that are easiest to make:

- Two thirds of 65+ year old homeowners have tanks, pipes and radiator insulation (67%), compared to just three in 10 (29%) 18 to 34 year olds.

- Similarly, two thirds of 65+ year old homeowners have draught-proofing (64%), while only 27% of 18 to 34 year olds report having this.

Figure 11: Levels of insulation homeowners reported by age

Source: Which? Sustainability Tracker 2024. Respondents were asked Does your home have any of the following insulation improvements?. Bases: 65+ year old homeowners (413), 55 to 64 year old homeowners (243), 35 to 54 year old homeowners (500), 18 to 34 year old homeowners (260).

This suggests that younger homeowners may not be aware of the simpler and cheaper insulation improvements they could make.

Most homeowners believe their home needs more insulation

We asked homeowners what is preventing them from insulating their home further. Whilst three in 10 homeowners (29%) said they don’t think their home needs any more insulation, two thirds of homeowners (67%) cited at least one barrier. This shows that the majority of homeowners think they need more insulation in their home but are being held back from being able to do so.

Cost is the most common barrier stopping homeowners from insulating further

Amongst those who think they need more insulation, cost was the biggest barrier with almost half (46%) saying they can’t afford it (Figure 12). Related to this, a quarter of this group (24%) felt that insulation improvements wouldn’t reduce their bills enough to be worth it.

In addition homeowners reported several non financial barriers; one in five (19%) said it wouldn’t be appropriate for their property, and similar proportions said it would be too much hassle (18%) or that they don’t have enough information to make an informed decision (18%). 13% of homeowners said it would be difficult finding a trader they trust.

Figure 12: Barriers preventing homeowners insulating their homes further

Source: Which? Sustainability Tracker 2024. Respondents were asked Which, if any, of the following is stopping you from insulating your home further?. Bases: Homeowners who don’t think they have sufficient insulation (1,011).

This data shows that improving home insulation is a difficult issue for homeowners. Whilst cost concerns are by far the main barrier to homeowners, a number of other issues that are more related to information, advice and trust also hold homeowners back.

While most barriers are similar across property type, some large differences exist

The barriers homeowners face are fairly consistent across property types. For example, similar proportions said it would be too much hassle (16-20%). However, the main differences are:

- A higher proportion of homeowners in semi-detached (50%) or terraced houses (51%) reported they wouldn’t be able to afford improvements than homeowners in flats (41%) or detached houses (37%). This is likely due to homeowners in detached houses tending to have higher household incomes.

- A higher proportion of flat owners reported that it wouldn’t be appropriate for their property (42%) compared to other property owners - likely due to limits to the changes they can make to their building.

Older homeowners are less likely to cite cost as a barrier

Cost as a barrier is more common amongst homeowners under 55 (Figure 13). Over half of 18-34 year olds (52%) and 35-54 year olds (54%) cited that they can’t afford to insulate further, while only a third of over 65 year olds said so (33%).

Figure 13: Cost cited as a barrier to insulation installation by age

Source: Which? Sustainability Tracker 2024. Respondents were asked Which, if any, of the following is stopping you from insulating your home further?. Bases: Homeowners who don’t think they have sufficient insulation, 18 to 24 year olds (52), 25 to 34 year olds (151), 35 to 44 year olds (182), 45 to 54 year olds (196), 55 to 64 year olds (160), 65+ year olds (270).

Summary

This section has shown that two of the main barriers to homeowners improving their home insulation are concerns about the cost and a lack of information and advice.

Solar panels

Solar panel ownership and consideration

According to the latest government data, 5% of UK households have solar panels. Ownership is higher amongst homeowners, with one in 10 (11%) homeowners we surveyed saying they already have solar panels installed. [3] Of those without solar panels, homeowners are split over whether they would consider installing them in the future; while a quarter of homeowners (27%) said they would consider it, just over a third said they might consider (37%) or won’t consider it (36%).

While we did not ask respondents about the barriers that prevent them installing solar panels, by looking at differences in ownership and consideration across socio-demographic characteristics we can infer what some of the barriers may be.

Homeowners likelihood to consider solar panels is linked to property type

4% of flat owners reported that their property has solar panels. Amongst those who don’t have them, the majority (55%) said they would not consider installing in the future, probably due to them not having ownership or access rights to their roof.

Amongst homeowners in other types of properties, solar panel ownership is twice as common in detached houses (17%) than semi-detached houses (9%) or terraced houses (8%) (Figure 14). This may be due to homeowners in detached houses being more likely to have a higher income and more roof space to install solar panels.

Figure 14: Solar panel ownership by property type

Source: Which? Sustainability Tracker 2024. Respondents were asked Do you have solar panels installed in your home? Bases: Detached house homeowners (491), Semi-detached house homeowners (698), Terraced house homeowners (461), Self-contained flat, maisonette or apartment (349).

Openness to installing solar panels in the future is similar across these property types.

While solar panel ownership is similar across income levels, higher income households are more open to installing in the future

A very similar proportion of homeowners of different income levels have solar panels (10-13%). However, those on higher incomes are much more open to installing solar panels in the future (Figure 15). One possible reason for this difference is that those with solar panels currently may have benefited from grants in the past, whilst those who do not are deterred by the cost of installing them in the future.

Figure 15: Solar panel ownership and consideration by household income

Source: Which? Sustainability Tracker 2024. Respondents were asked Do you have solar panels installed in your home? and Would you consider installing solar panels in your home in the future? Bases: Under £21,000 (199), £21,000 to £48,000 (486), Over £48,000 (434).

Younger homeowners are most likely to consider solar panels in the future

The older the homeowner, the less likely they will consider installing solar panels. Half of 18-24 year olds said they would consider solar panels (48%), compared to just one in ten over 65 year olds (10%) (Figure 16).

Figure 16: Solar panel consideration by age

Source: Which? Sustainability Tracker 2024. Respondents were asked Would you consider installing solar panels in your home in the future? Bases: Homeowners, 18 to 24 year old (52), 25 to 34 year old (178), 35 to 44 year olds (219), 45 to 54 year olds (238), 55 to 64 year olds (218), 65+ year olds (351).

Summary

Solar panels are already a relatively popular measure with one in ten (11%) homeowners having them. However ownership has the potential to increase further with a quarter of homeowners (27%) that don’t currently have solar panels saying they would consider installing them in the future and just over a third (37%) saying they might consider it.

Similar to our sections on heat pumps and home insulation, cost is likely to be a major barrier to homeowners installing heat pumps. This is demonstrated by homeowners with higher household incomes being much more open to installing them in the future.

Further research is required to uncover non-financial barriers that might prevent homeowners installing solar panels.

Chapter 4: Policy recommendations

In order to meet the UK’s legally binding commitment to net zero, most households in the UK will have to make significant changes to the way they heat their homes. Positively this can also deliver lower energy bills and make homes warmer and more comfortable.

However our research in Chapter 3 suggests that key indicators such as homeowners' awareness of heat pumps, and willingness to consider installing a heat pump, have changed little in the last year. Given the rate of acceleration recommended by organisations such as the Climate Change Committee, the UK and devolved governments as well as businesses will need to do much more to support homeowners in this transition. Homeowners have identified a number of barriers that prevent them making the changes required.

Limited awareness, and a lack of information and advice are a significant barrier in relation to both heat pumps and insulation. Currently nearly half of homeowners are unaware of what heat pumps are (43%). Amongst those that are aware of heat pumps, a third said they were concerned that the technology would not be good enough to heat their homes. This is despite evidence that heat pumps are a good heating option in most, if not all, types of homes.

The same issues of awareness, information and advice can be seen in relation to home insulation. Although there is general awareness of insulation, many are unaware of what insulation they have.

High upfront costs are also a recurring concern for homeowners. Seven in 10 homeowners said a heat pump would be too expensive for them to install and almost half (46%) of those who think they need more insulation said they can’t afford it. Similarly for solar panels, richer households were much more likely to say they would consider installing them in the future, demonstrating that cost is likely a major barrier to poorer homeowners.

For some households that can afford these changes, improving or emphasising the benefits of making changes may increase uptake. ‘Reducing energy bills’ was the main motivating factor that would encourage homeowners to consider a heat pump.

There are also some additional barriers that homeowners encounter once they have decided to look into improvements. For example, 13% of homeowners who think they need more insulation said that difficulty finding a trader they trust is stopping them. NESTA’s research into those looking at having a heat pump installed also identified that trusting installers, along with noise regulations and planning permissions is holding back adoption.

Heat pump installations are currently rising rapidly but from a low base. Our research suggests that in each of the three areas where change is required - installing a heat pump, improving insulation or installing solar panels - there are groups of homeowners that are open to making these changes. These groups can often be identified by their motivations, their ability to pay, or their age. And as more households make these changes it is also likely that they will become more familiar, which will encourage others.

However our research also suggests this will not be enough to generate sustained growth. Many homeowners will be looking to governments and businesses to provide more support before considering these changes.

Which? has identified three important areas where the UK and devolved governments will need to take action to support consumers in the transition to more sustainable home heating. The Warm Homes Plan offers the UK government an opportunity to tackle these consumer barriers holistically and support consumers in this transition. In our recommendations we have included the need for homeowners to be able to find installers that are reliable and qualified. Although this doesn’t appear as one of the main barriers, our previous research shows that many consumers struggle to trust the information provided by installers and poor installations and rogue traders can cause considerable financial and emotional harm, as well as undermining other consumers' trust in the changes that are required to meet net zero.

Improving awareness, information and advice

The UK and devolved governments should:

- Run public campaigns to raise consumer awareness about insulation and low carbon heating, such as heat pumps. The campaigns should have consistent messaging and be run in collaboration with businesses and civil society groups that can help to disseminate information at the times and in the places where consumers need it.

- Provide reliable information about heating systems, insulation and solar panels as well as sources of financial support and how to identify qualified and reliable installers.

- Provide consumers that need it with opportunities to access independent advice and support that is tailored to their property, including through accredited local and national One Stop Shops.

- Reform Energy Performance Certificates so that they are an accurate, useful and reliable source of information that acts as a gateway to other more detailed information. [4]

To address financial barriers

- The UK and devolved governments should ensure households in fuel poverty have access to grants to improve the insulation of their homes and install efficient heating systems. More work is needed to address trust issues, and accessibility for low income households that are not in receipt of benefits.

- In line with their manifesto commitment, the UK government should work with the private sector to support the development of green financial products and new business models that meet consumers’ needs and have strong consumer protections that protect consumers from harm.

- In order to support the transition to electrified heating and reduce running costs it islikely the government will need to address the higher price of electricity compared togas. This should be done in a way that doesn’t unfairly penalise consumers that areunable to move to electrified heating and are already subject to high energy bills.

To make it easy to find a reliable and qualified installer

- The UK government should set a date by which all tradespeople that install low carbon heating, micro generation and insulation are certified by MCS (for low carbon heating and micro generation) or TrustMark (for insulation) and ensure that these schemes are focused on delivering good consumer outcomes and abide by the CMA’s Good Practice Principles for Standards Bodies.

- In advance of this date the government should continue to clearly recommend that consumers use installers that are members of these schemes, and encourage other businesses, such as energy providers and financial providers that increasingly provide information and advice to homeowners, to do the same.