Make money make sense

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

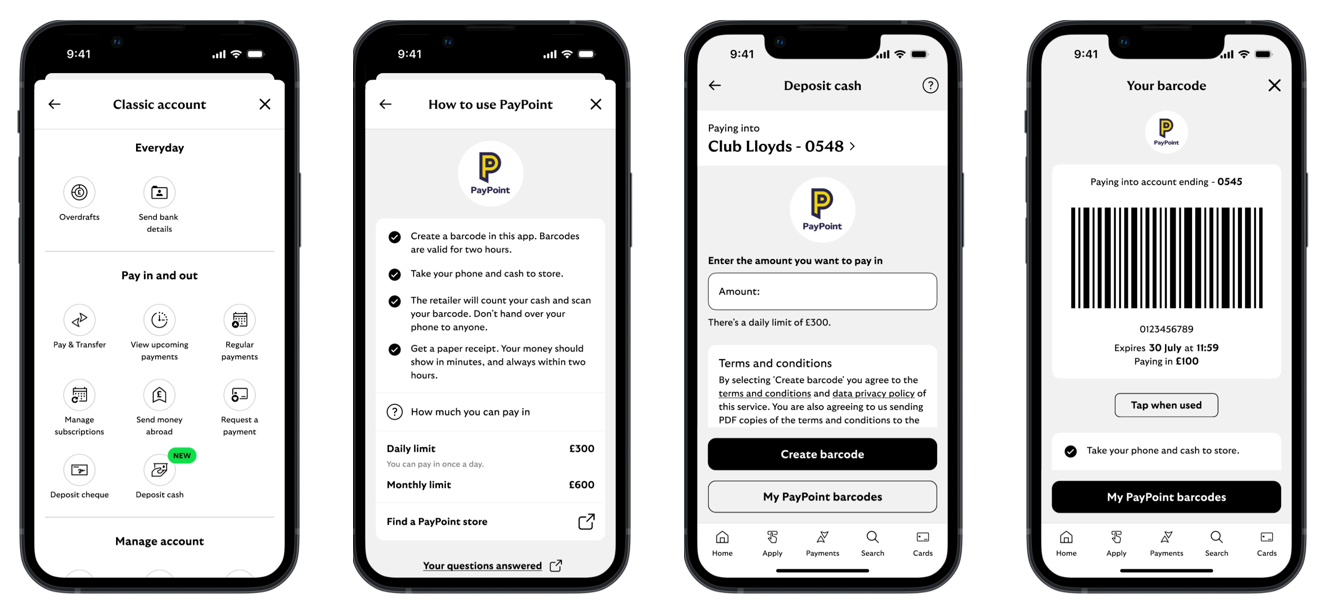

If you bank with Lloyds, Halifax or Bank of Scotland, you’ll soon have a new way to pay in cash to your bank account.

A partnership with PayPoint means you’ll be able to deposit money at thousands of local shops – offering more choice alongside branches, banking hubs and the Post Office.

Here, Which? takes a look at what the new service offers, how it works and how it compares to other ways of paying in cash.

Coming from 26 August, Lloyds Banking Group customers will be able to pay up to £300 in notes and coins into their accounts using PayPoint.

You’ll be able to deposit up to £600 each month, or up to £7,200 a year.

The service – a first for a major bank – runs alongside Lloyds’ usual deposit options. You’ll still be able to visit a branch, use a banking hub or deposit money at the Post Office.

PayPoint is a network of local shops, including newsagents, convenience stores and supermarkets, that act as payment agents for a wide range of services.

As well as accepting deposits and withdrawals, PayPoint outlets can also handle bill payments – including council tax and energy – plus mobile top-ups and balance checks.

There are around 30,000 PayPoint locations across the UK, with 94% open seven days a week. You can find your nearest using the store locator or through the Lloyds banking app.

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

Lloyds Banking Group may be the first major bank to partner with PayPoint, but it is not the only provider offering cash deposit services this way. Both Monzo and Revolut offer cash deposit services through PayPoint.

Lloyds and Monzo both cap individual transactions at £300, but Monzo allows up to £750 a month — £150 more than Lloyds.

Revolut offers the most flexibility, with a £500 transaction limit, a £750 daily cap, and a £2,250 monthly maximum.

Lloyds doesn’t charge for using the PayPoint service. Monzo charges £1 per deposit, while Revolut charges 1.5% of the total. These charges are taken directly from the amount you pay in.

For example:

Find out more: could this be your new bank branch?

Lloyds says deposits should arrive within minutes.

Revolut says deposits usually show within 8 to 10 minutes, while Monzo estimates around 10 minutes. Both say it could take up to 30 minutes during busier periods.

Lloyds’ new service is aimed at customers who use its banking app, as you can only pay in cash by generating a barcode through the app. Lloyds has confirmed there’s no other way to use the service. This means if you don’t have a smartphone or choose not to use the app, you won’t be able to access this new feature.

By contrast, Monzo and Revolut customers use their debit cards to pay in cash at PayPoint.

There’s currently no barcode option through their apps. But since both are digital-only banks, they don’t offer branch access or in-person banking services — something Lloyds customers still have.

Most high street banks, including Lloyds, have partnerships with the Post Office, allowing you to carry out everyday banking tasks such as depositing notes and coins.

You’ll usually need your debit card and Pin to pay in cash. Some banks may also require a specific paying-in slip. Coin deposits often need to be sorted and bagged in full denominations.

Deposit limits vary depending on your bank and account type. Post Office branches also have their own cut-off times — if you pay in after the cut-off, your transaction might not be processed until the next working day.

You can check the full list of participating banks on the Post Office website.

Across its three brands, Lloyds Banking group has 28 million UK customers, with more than 20 million using their mobile banking apps.

In our most recent survey, both Halifax and Lloyds Bank received a customer satisfaction score of 75%, followed by the Bank of Scotland at 72%.

Halifax and Lloyds both received five stars for online banking services, and four stars for mobile banking. Bank of Scotland received four stars for online banking and four stars for its mobile app.