Search for deals to cut your bills

Use our advice, ratings and customer scores to help you choose with confidence

Compare and choose

In this article

Credit reports are compiled by credit reference agencies (CRAs) – the main agencies in the UK are Experian, Equifax and TransUnion – and you have the legal right to check your report for free with all three.

You can also check your credit score for free (and you can check it as often as you like without doing any harm). This is a three-digit number that tells lenders how reliable you are at borrowing and repaying money.

It's calculated using information in your credit reports, which can reveal how you've managed your debts and bills in the past.

There's no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

Experian is the largest credit reference agency and all you need to do is download the Experian app to see both your credit report and your credit score for free.

It could help you save money by comparing credit deals based on your financial profile and shows you a summary of all your borrowing and the cards and loans you’re likely to be accepted for.

Experian also offers new customers a free 30-day trial of its CreditExpert service, which gives you access to your credit report, score, plus insights into what is affecting your score and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

If you've already made use of the free trial, or you aren't able to use the app, you can access your Experian credit score through a free online Experian account.

Once you've signed up, your score will remain free to access, but, unlike the app and the paid-for CreditExpert service, you won't be able to see your credit report.

Experian Boost is also free to all customers, which lets you connect your current accounts via Open Banking so that you can count things like Council Tax payments, transfers to savings accounts and even subscriptions to services Netflix and Spotify to potentially boost your credit score (don't worry, it will not make your score go down).

You can get your Equifax report and score free through ClearScore, which makes its money from commissions on products you take out via its website.

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £14.95 a month after the free trial.

You can access your TransUnion report and score for free via its Credit Karma (formerly called Noddle) service.

This agency advertises loans and cards you are likely to be accepted for too.

You can also access your TransUnion credit report for free via the Money Saving Expert Credit Club.

Signing up for a free trial with CheckMyFile will give you access to all the information held on you by TransUnion, Experian and Equifax for 30 days.

After this, you'll have to pay £14.99 a month to keep the service.

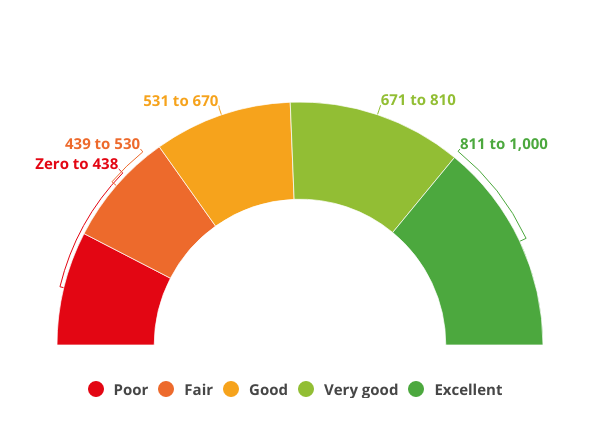

Each credit reference agency uses its own scoring system. The table shows the scale each one uses and what a particular score means in terms of your creditworthiness.

| Experian (0-999) | What your score means | Equifax (0-1,000) | What your score means | TransUnion (0-710) | What your score means |

|---|---|---|---|---|---|

| 961 - 999 | Excellent | 811 - 1,000 | Excellent | 628 - 710 | Excellent |

| 881 - 960 | Good | 671 - 810 | Very good | 604 - 627 | Good |

| 721 - 880 | Fair | 531 - 670 | Good | 566 -603 | Fair |

| 561 - 720 | Poor | 439 - 530 | Fair | 551 - 565 | Poor |

| 0 - 560 | Very poor | 0 - 438 | Poor | 0 - 550 | Very poor |

To give you a better idea of how your application might be viewed by lenders, credit reference agencies produce their own version of your credit score.

The higher this number, the higher your chances of getting access to market-leading credit deals. However, a good credit score from a credit reference agency is no guarantee that your application will be successful.

And confusingly, each credit reference agency uses a slightly different scale. For example, a score of less than 560 is 'very poor' with Experian, but 'good' with Equifax.

Use our advice, ratings and customer scores to help you choose with confidence

Compare and chooseYour score will ultimately be based on how responsibly you use your credit facilities.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency, for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity. As lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

A lender can conduct either a 'hard' or a 'soft' search when you apply for credit:

While it doesn't matter how many soft searches there are (as only you can see them), multiple hard searches - particularly within a short period - can lower your credit score.

When shopping around online, check if a provider is offering a soft or hard search before entering your details.

Want to make your home more energy efficient? Use our free home energy planning service.